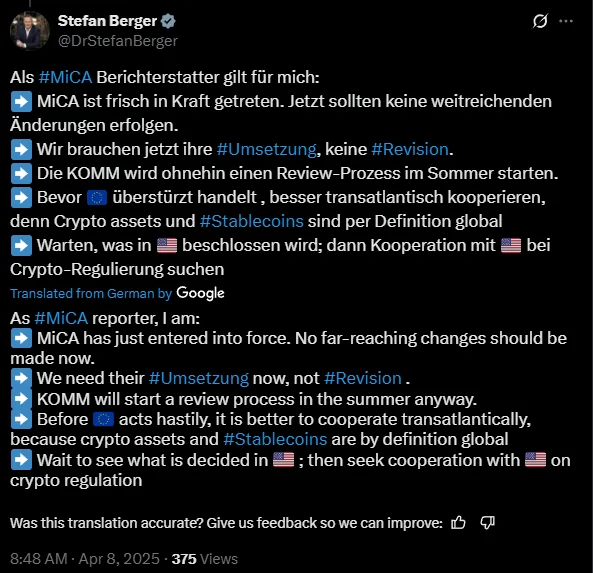

MEP Stefan Berger has emphasized the importance of enforcing the Markets in Crypto-Assets (MiCA) regulation within the European Union rather than revising it. He suggests waiting for decisions from the United States before coordinating on global cryptocurrency regulation, as crypto assets and stablecoins are "by definition global." Berger made these remarks in an April 8 post on X.

"MiCA has just entered into force. No far-reaching changes should be made now," said Berger, Member of the European Parliament. "We need their implementation now not revision. KOMM will start a review process in the summer anyway. Before EU acts hastily, it is better to cooperate transatlantically, because crypto assets and stablecoins are by definition global; wait to see what is decided in USA, then seek cooperation with USA on crypto regulation."

According to Berger, the EU should avoid immediate changes to the newly enacted MiCA rules, stressing the need for "implementation now, not revision." He noted that a review is already scheduled for the summer and advised against acting "hastily." Berger suggested that the EU wait for U.S. decisions on crypto regulation before pursuing transatlantic cooperation due to their "global" nature.

Stefan Berger's post

| X

In a related development, U.S. Senator Bill Hagerty (R-TN), along with Senators Cynthia Lummis (R-WY), Kirsten Gillibrand (D-NY), and House Banking Committee Chair Tim Scott (R-SC), introduced the GENIUS Act aimed at regulating payment stablecoins. This act builds upon the Lummis-Gillibrand Payment Stablecoin Act proposed in April 2024. The GENIUS Act designates permitted payment stablecoin issuers as financial institutions under the Bank Secrecy Act and restricts payment stablecoin issuance in the U.S. to approved issuers, including subsidiaries of insured depository institutions, federally qualified nonbank issuers, and state-qualified issuers.

The European Union's MiCA establishes uniform rules for crypto-asset issuers and service providers not covered by existing EU laws. It aims to ensure transparency, consumer protection, and market stability with specific obligations for different types of crypto-assets, including e-money and asset-referenced tokens. The regulation will be effective from December 30, 2024, with provisions on governance, disclosure, and preventing market abuse overseen by EU authorities like the European Banking Authority (EBA) and European Securities and Markets Authority (ESMA).

Berger represents North Rhine-Westphalia as an MEP for the Christian Democratic Union (CDU), covering regions such as Lower Rhine, Düsseldorf, and Mettmann since 2019. He serves on the Committee on Economic and Monetary Affairs (ECON), focusing on competition, digitalization, innovation, and crypto assets.